Anyone looking for a „short“ summary of Amazon quickly comes up against its limits. Nothing about Amazon is short, because the complex business model requires explanation.

Does Amazon earn its money by selling products or as a service provider? Does Amazon see itself as a retailer or cloud provider or even a film studio or fashion brand? Is there a brand strategy behind all products? And why is everyone talking about „Day One“? In the following article, we want to take a look behind the scenes of the tech giant and show how it all began, where the company stands today and what strategy and philosophies make the company so successful.

1. Founding story: How did the bookstore become a billion-dollar corporation?

Amazon is the global market leader in online retailing. Many people can no longer imagine shopping online without the internet giant. Many retailers can no longer run their business without the digital sales platform. But how did a small software start-up become an innovative tech giant with a multi-layered business model?

In 1994, American Jeff Bezos founded Amazon.com in his garage in Seattle. In 1995, the online retailer sold its first book and one year later introduced the now famous customer reviews. As early as 1998, Amazon celebrated its 1,000,000th customer and the company opened its digital shop doors in Germany. The first logistics centre in Bad Hersfeld followed a year later.

In 2000, new categories such as DVDs, videos and electronic items are added to the books sold so far. In 2002, Amazon opens its marketplace to third-party sellers. Between 2003 and 2005, Amazon launches the sale of kitchen, household and home articles as well as the DIY and garden shop. In 2005, the online retailer launches the Amazon Prime offer, making fast delivery the new standard on the internet.

Amazon is an innovation driver in cloud computing. In 2006, Amazon Web Services (AWS) is launched and today supports hundreds of thousands of companies and public authorities. Amazon continues its evolution from an online bookseller to an e-commerce partner to an infrastructure company. Thanks to the cloud, fixed costs become variable and server and other IT resources can be planned and procured at short notice.

In 2007, Amazon launches its sports, leisure, footwear and accessories shop and comes ever closer to its vision of the largest selection on an online platform. In the same year, Amazon Kindle is launched and thanks to Kindle Direct Publishing, authors can now publish their books themselves. Amazon shakes up the publishing world.

Since 2010, Amazon has been developing its own scripts with Amazon Studios. Amazon Drive and Amazon Prime Video followed a year later. Four years later Amazon Fire TV and the Fire TV Stick are launched. The company succeeds in one of its biggest innovations in 2015 with Amazon Echo. The smart speaker is controlled with the AI technology Amazon Alexa.

In the same year, Amazon revolutionises the world of consumers with the Amazon Dash Button. The ordering service for consumer goods ensures, for example, that the missing milk is reordered at the touch of a button in the fridge. However, the service is completely discontinued at the end of the year. As we will see later in Amazon’s brand analysis, testing out ideas is in Amazon’s DNA. This includes the knowledge that not all innovations, products and services will be successful in the long term.

In 2017, Amazon Fresh is launched and the company digitises weekly shopping. Research also becomes an increasingly important field for Amazon and in 2018 the company launches an AI partnership with the Max Planck Society in Cyber Valley. A year later, Amazon again makes headlines with its Amazon Go offering, a supermarket of the future.

2. Revenue by business segment: How does Amazon make money?

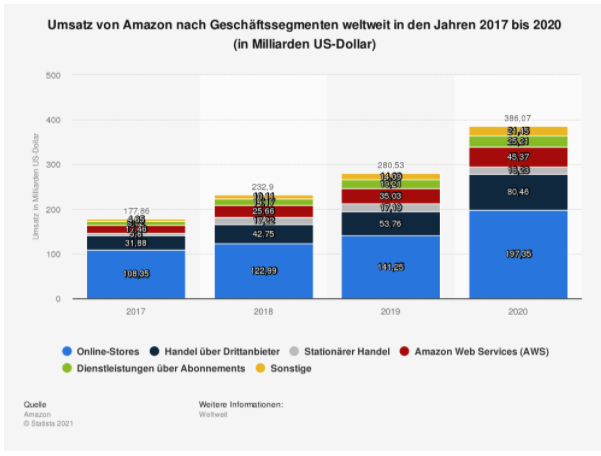

In 2019, Amazon generated over US$280 billion in revenue, of which 11.5 billion was net profit. USA is Amazon’s largest market by revenue at $193 billion, followed by Germany at $22 billion, UK at $17 billion, Japan at $16 billion and the rest of the markets combined at $31 billion. The focus on geographical markets is clear: as an American company, the USA is and remains the largest market. What about Amazon’s business segments?

A journey through the last 20 years of Amazon shows how incredibly multi-layered the company has become. Is Amazon now an online retailer, e-commerce platform, IT infrastructure company, publisher, film studio or supermarket chain?

Amazon’s revenue in 2019 breaks down by business segment as follows: Over 50% of revenue comes from online commerce, 19% flows in from third-party commerce, 12% is generated by AWS (IT infrastructure services), 6% comes from Amazon’s physical shops, 6% accounts for subscription services (e.g. Amazon Prime, Amazon Music, Kindle Unlimited, Audible) and 5% services such as advertising and ads.

Amazon’s core business is still based on the e-commerce platform. Half of all revenues are generated by online commerce and amount to 197 billion US dollars in 2020. Those who assume that Amazon is a product company are nevertheless wrong. Online retail is where the lowest margins lie. Competitors in this segment are companies like JD.com or even Walmart.

The growth in operating income was mainly possible due to the high margins in the other business segments such as Amazon Web Services (AWS). AWS offers hundreds of cloud-based services, including data storage, analytics or even artificial intelligence. In 2020, Amazon generated 45 billion US dollars in revenue with this segment. Competitors for this are companies and their offerings such as Google Cloud and Microsoft Azure.

Another segment is third-party services, which account for 19% of Amazon’s revenue and have a turnover of 80 billion US dollars in 2020. Third-party sellers can sell products through Amazon’s marketplace and pay fixed fees, revenue sharing and flat shipping rates. Competitors in this area are the platforms ebay and Etsy.

Subscription services are a lucrative and important business for Amazon. The best-known subscription is Prime, which includes digital services such as Prime Video, Prime Music and Prime Reading. Last year, the tech giant generated $25 billion in revenue with these services, and the trend is rising. Netflix and Disney are competing with Amazon here.

The physical shops, with a turnover of 16 billion US dollars, account for 5% of the turnover. Amazon owns supermarket chains but also other physical shops like Amazon Books, Amazon 4-star, Amazon Go or Amazon Pop-Up. Competitors in the USA are Walmart, Barnes & Noble or Costco Wholesale.

The remaining 5% of Amazon’s revenue is categorised as „Other Services“ and delivered $21 billion in revenue in 2020. This mainly includes advertising revenue but also other offerings such as co-branded credit cards. This business segment has grown by over 70% each year. That’s seven times as much revenue as Twitter has generated – and Twitter lives almost mainly on it.

Selling products comes with lower margins, so high-margin services like Amazon Advertising Services, Amazon Prime and Amazon AWS are becoming increasingly important for the company. This is where the biggest potential lies for the tech giant and the focus for the future.

Source: Amazon. (2 February, 2021). Amazon’s revenue by business segment worldwide from 2017 to 2020 (in billions of US dollars) [Graph]. In Statista.

3. Target groups and the fly-wheel effect: Who plays the biggest role for Amazon?

Amazon’s business model has four main target groups. One of Amazon’s key brand values is customer centricity. Therefore, end customers play the most important role. Amazon promises the highest selection and delivery convenience at the lowest prices. Who can say no to that as a consumer?

43.9 million people in Germany order regularly from Amazon. Of these, 40% take advantage of a paid Prime membership. These almost 17 million Prime users make an important contribution to the company’s success, because their purchase frequency is higher and more consistent than that of non-Prime customers. The young target group in particular appreciates the offer. 42% of German online customers between the ages of 16 and 24 are Prime customers.

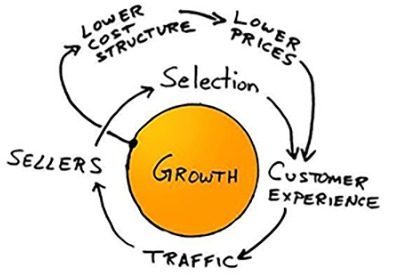

Amazon’s mission at the time of its founding was none other than to be „the most customer-focused company in the world“. Jeff Bezos wanted to grow by putting the customer first. According to legend, Bezos drew a sketch for this, which we know today as the „Flywheel“. In the middle is growth. To set this in motion, positive customer experiences are needed.

With positive experiences, the number of visitors increases, which in turn makes the platform interesting for sellers. The assortment grows and this in turn leads to higher customer satisfaction. A cycle is created, at the centre of which is growth through enthusiastic customers. The growth achieved ensures that Amazon can lower its own costs and thus the prices passed on. And that leads to – you guessed it – increased customer satisfaction.

Source: Amazon

Amazon’s second important target group is the sellers, without whom such choice and variety would not be possible. Merchants can not only resell products on the online platform, but also create their own brand pages and realise shop-in-shop experiences for end users. Amazon charges fixed fees and revenue shares for this and offers various sales programmes.

Amazon’s third target group is developers and companies, which are addressed with Amazon Web Services (AWS). AWS is a cloud service platform that offers database storage, computing services and other functions. The aim is to help startups and companies scale and grow.

Thanks to the low-cost infrastructure platform in the cloud, Siemens, for example, can defend against over 60,000 cyber threats per second thanks to machine learning, or the start-up mapbox can collect 100 million raw data for their maps every day.

The fourth target group is content creators, such as authors, musicians, filmmakers or app developers. With Amazon Kindle, authors can publish their books themselves. Bands can publish their albums via Amazon Music. Content creators play a big role in the platform economy and will become increasingly important in the future.

4. Brand strategy: What does Amazon stand for?

Amazon is one of the most customer-centric companies in the world. The company’s brand values are innovation, accessibility, customer focus and excellence. To characterise brands, one speaks of so-called „archetypes“. These are universal archetypes that are associated with certain characteristics and emotions. Archetypes are nowadays used in marketing for positioning and storytelling. Amazon’s brand archetype is the „hero“. He is strong-willed and self-confident, his goal is domination and change.

The company sees itself as a „pioneer“ and „inventor for consumers“. It is always testing new categories, venturing into uncharted waters and is aware that not all business ideas will work out. Jeff Bezos says: „Our passion for pioneering will drive us to explore narrow passages, and many will inevitably turn out to be dead ends. But – with a bit of luck – there will also be some that open up to wide paths.

Amazon’s success is based on three rational benefits: The widest selection of products, the lowest prices and the convenience of delivery. These benefits have been embedded in Amazon’s DNA for years. Jeff Bezos prioritises them accordingly, emphasising: „We firmly believe that customers value low prices, a wide selection and fast, convenient delivery, and that these needs will remain stable over time. It is hard for us to imagine that in ten years customers will want higher prices, less choice or slower delivery.“

Amazon’s brand architecture is based on the branded house approach. Here, a hierarchically superior umbrella brand dominates the market presence and reduces the influence of hierarchically subordinate brands to a minimum. Amazon is continuously expanding its business segment using the company name as an umbrella brand, such as Amazon Prime, Amazon Kindle, Amazon Echo or Amazon Fashion. This allows the brand to gain attention for its new products relatively quickly.

According to Statista, Amazon is the most valuable brand in 2021, with 683.85 billion US dollars, well ahead of Apple, Google and Microsoft. Amazon was able to increase its brand value by 60% compared to the previous year. The ranking is based on the methodology of the market research company Kantar, which calculates financial value and brand contribution. The ranking provides information on the question of what it would cost to build the brand from scratch.

5 Comparison: What distinguishes and connects Google, Amazon, Facebook, Apple and Microsoft?

There are five major tech giants that are indispensable in today’s world. We use their products and services every day and many of us even work there. The US corporations Google, Amazon, Facebook, Apple and Microsoft – GAFAM for short – combine enormous growth and are emblematic of the success of the New Economy.

Each of these companies started with a core product that has increasingly lost importance in recent years in favour of new business areas.

Google started as a search engine and is now a personalised advertising company. In 2020, Google made a turnover of 146 billion US dollars with their advertising business.

Apple started with computers and today still makes 50% of its turnover with the iPhone. However, 20% of its turnover is generated with iTunes, software and digital services – and the trend is rising. With its entertainment division, Apple is trying to diversify further.

Facebook has a similar model to Google and generates its revenue through personalised advertising. An exact analysis of user habits allows for the targeted playout of advertisements to desired target groups. The group is diversifying by buying up WhatsApp and Instagram, as well as taking stakes in companies in the virtual reality hardware sector.

Amazon is also upgrading its cloud business and has become the world’s largest cloud provider in recent years. In addition, the e-commerce giant regularly innovates new business areas, such as in the development of supermarkets, which are automated and made more customer-friendly through technical possibilities, so-called „cashless stores“.

Microsoft still relies on personal computing, but its cloud business has more than doubled from 2014 to 2020. Today, the company makes 48% of its revenue from cloud solutions. LinkedIn is also part of Microsoft and helps the giant diversify its portfolio, as does the entertainment sector with Xbox.

Diversification is a strong growth strategy for GAFAM. All companies have become successful by expanding their service programmes to new products and markets. On the one hand, this offers many opportunities: counteracting market saturation, spreading risk across economically independent markets, reinvesting profits and exploiting synergy benefits. At the same time, diversification is a dangerous strategy, because unknown markets have to be explored and cannot always be conquered. It is not surprising, for example, that Amazon is discontinuing its Dash button. Ordering at the touch of a button on the fridge did not catch on and did not prove lucrative for the company.

However, the great success of all the tech giants is not only built on the diversification strategy, but also on the changing user behaviour of the global population. All five companies tapped into the right markets at the right time. Four billion people use the internet for an average of seven hours a day. The number of smartphone users is increasing. The importance of e-commerce continues to grow. In 2025, the e-commerce market is expected to generate almost 3.1 trillion euros worldwide. This is a more than good starting position for GAFAM’s further growth.

6. Corporate culture: What is behind the day 1 mantra?

Amazon is also very well known as an employer brand. The core of the corporate culture is formed by the 14 leadership principles, such as „Learn and Be Curious“ or „Deliver Results“. Amazon insists that their leadership principles „are not just nice inspirational sayings“ but are continuously applied by employees. Amazon is overwhelmingly popular as an employer. In recent years, however, the tech giant has increasingly had to work on its positive image. Low wages and prevailing working conditions in the logistics centres brought Amazon into the negative headlines.

Anyone concerned with Amazon’s culture cannot avoid the mantra „Always Day 1“. In almost all shareholder letters, Jeff Bezos appeals to his readers: „Our approach remains the same, it’s still Day 1“. When visiting Amazon’s headquarters, it is noticeable that the building in which Bezos sits bears the name „Day 1“. The official company blog is called „dayone“. Why is Day 1 so important for the entrepreneur and what is behind it?

Startups are incredibly fast, flexible and nimble in their early stages. They accept high risks and are willing to experiment. But with growth comes complexity. The once nimble start-up becomes a sluggish large organisation. In physics, there is a measure of disorder called entropy. The disorder in our universe is inevitably and steadily increasing. Jeff Bezos has applied this physical law to the business world and found: No matter how great a company is, over time its efficiency will decrease and its rigidity will increase.

Bezos wanted to avoid inertia with all its side effects for his company. That’s why, based on his insights from physics, he emphasises: „We want to fight entropy“. For him, it is clear – if no one does anything about it, Amazon will become just another average large company that hinders itself in its ability to innovate. By continuously reminding himself and his employees to maintain the startup mindset, he wants to counter rigid structures.

The „Day 1“ mindset contains the four rules of a start-up: customer centricity comes first, results are more important than processes, decisions must be made quickly and external trends must be adapted. Derived from this is a constant readiness for innovation. The „Day 1 mentality“ is both a culture and an operating model. It has successfully carried Amazon through various business models for over 20 years and ensures that we will continue to hear a lot from the tech giant in the future.