Why Amazon needs to become more like YouTube if it wants to dominate all online commerce

Amazon is the measure of all things in German online trading. Continuous sales growth year after year (2017 17.4% vs. 10.9% market growth) at a very high sales level leaves the competition astonished. Group revenues rose from $145.987 billion to $177.866 billion in 2017, reaching a new record high. Despite the impressive figures, there is still some potential for optimization at Amazon, especially with regard to the personalization of the products on display.

In this article I will therefore discuss the strengths and weaknesses of Amazon and explain why Amazon has to orient itself to YouTube in order to cover further shopping segments and thus be able to maintain its growth course.

Current status of Amazon:

Amazon.de ranks fifth among the most visited websites in Germany

Amazon’s IOS and Android apps are the third most popular shopping apps in Germany (only Wish and eBay classifieds are before Amazon)

More than 17 million people in Germany are Amazon Prime subscribers

On Amazon.de there are approx. 230 million products as well as 64,000 salespeople.

34 % of all product searches take place directly on Amazon

Amazon’s success is based in particular on three main pillars:

Large selection

Low price

User Experience/simple order processing

Due to the seemingly endless selection of products (230 million), Amazon manages to direct more users to the online shop than any other online shop. The low price and simple order processing not only turn visitors into customers, but in many cases also into regular or prime customers.

A decisive success factor here is Amazon’s A9 algorithm. Amazon has been considered the most important product search engine in the western world for several years. The A9 algorithm used is relatively easy to understand.

When a search query is triggered, it first determines which products are relevant for the search query.

Whether a product matches the respective search query is determined by whether this search query is included in the product listing (title, bullet points, keywords, product description).

If this is the case, the product is taken into account for the search query. However, this does not mean that the product is displayed on the first search result page. The naming of the respective search query is rather the minimum requirement for the product to be included in the „shortlist“.

After this filter function has been applied, the filtered products are sorted according to performance factors (number of sales, conversion rate, click rates, etc.). As a result, products with the highest relevance and the best performance values are displayed on the front (organic) placements. This filter function ensures that the results displayed on average represent the products with the highest purchase probability.

The purchase probability is calculated in particular by historical values such as the purchase frequency as well as the keyword specific conversion rate.

Ultimately, this type of presentation results in popular products already receiving an even greater proportion of impressions, clicks and purchases. Thus, this type of presentation is both strength and weakness, because on average relevant products are displayed to customers, but at the expense of individual and personalized product presentation.

Examples of a lack of product diversity and personalization

In the following I show some examples, which should clarify the missing personalized and/or individualized representation.

Search query: Sunglasses for men

Presentation of 16 organic product listings

All product listings played out on the first search result page have a relatively low selling price (8.99 € to 25 €). Furthermore, no established sunglasses brands are displayed. Although Amazon has enough data available through my sales history to signal a clear brand preference in the higher price segment, only private label brands are shown in the lower price segment.

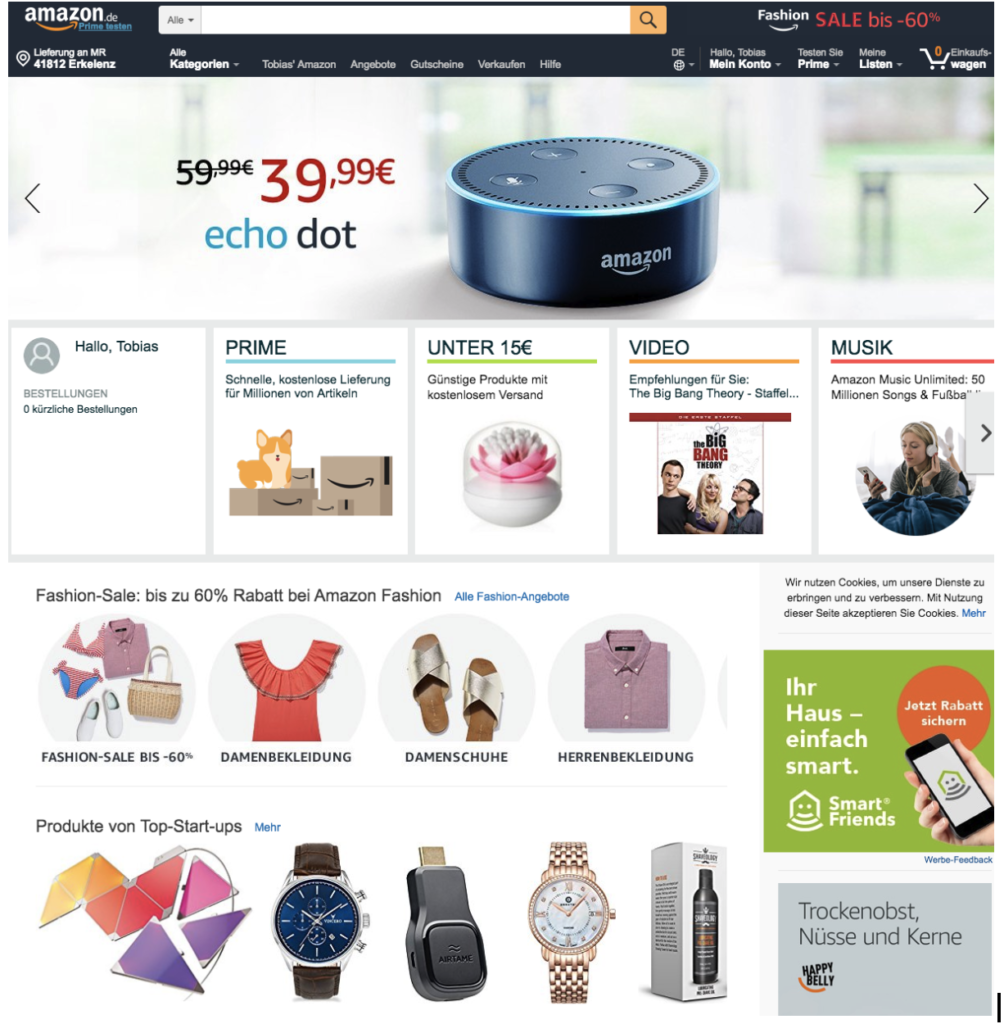

If you take a look at Amazon’s homepage, you will quickly see that Amazon does not serve as a source of inspiration for products. Amazon is currently geared towards meeting demand. So if you are clear about which product or which product categories to buy, Amazon is almost unbeatable due to the large selection, the lower prices and the fast delivery.

With this strategy, however, Amazon is neglecting impulse buyers who buy products not on the basis of a specific need, but because they want the product. At 70%, impulse buying accounts for the majority of retail sales. However, these impulse buyers are not picked up with Amazon’s search function because they have no acute need to purchase a product.

Impulse buyers can therefore only be won by personalising the shopping experience. Unfortunately, there is no provider in online retailing who can serve as a benchmark for the personalization of the shopping experience. Even providers such as Wish, who advertise with a personalized shopping experience, still have significant development potential in this respect.

YouTube is a platform that has not only answered search queries but also personalized the home screen in an exemplary way. YouTube is even the second most popular search engine in the world on the basis of the daily search queries. However, YouTube not only answers search queries by playing matching videos; it has also personalized the Home screen so that YouTube users often only end up on the home page and click their way through the videos suggested for them.

As a result, users not only visit YouTube when they want a particular search query answered with a video, but also when they are looking for entertainment. YouTube is not only the second largest search engine in the world, but also the second largest social network after Facebook.

YouTube would undoubtedly not be so popular if it only answered search queries. The personalized start page is the main reason why users open YouTube several times a day. A recent analysis shows that 70% of the time spent on YouTube is invested in automatic, personalized video suggestions.

Currently, Amazon customers use the Amazon website or app when they have a buying need. If Amazon succeeds in activating users more frequently by personalising both the search results and the start page or start screens, Amazon could become a source of inspiration from the pure consumer. This would enable Amazon to focus more actively on impulse buyers. Only by focusing more strongly on impulse buying can Amazon maintain its annual growth figures of approx. 20 % in the future.

Note: Of course, impulse buying is already taking place on Amazon, but the current website and the app are hardly designed for it. For more impulse purchases to take place on Amazon, the home screen would have to follow a personalized feed logic, similar to what YouTube, Facebook etc. are doing at the moment.