Why Amazon needs to become more like YouTube if it wants to dominate online retail as a whole

Amazon is the benchmark in German online retail. Continuous sales growth year after year (2017 17.4 % vs. 10.9 % market growth) at a very high sales level leaves the competition in awe. Group sales rose from 145.987 billion $ to 177.866 billion $ in 2017, reaching a new record level. Despite the impressive figures, however, Amazon still has a lot of potential for optimization, particularly with regard to the personalization of the products displayed.

In this article, I will therefore discuss Amazon's strengths and weaknesses and explain why Amazon needs to align itself with YouTube in order to cover additional shopping segments and thus maintain its growth trajectory.

Current status of Amazon:

- Amazon.de is the fifth most visited website in Germany

- Amazon's IOS and Android apps are the third most popular shopping apps in Germany (only Wish and eBay Kleinanzeigen are ahead of Amazon)

- More than 17 million people in Germany are Amazon Prime subscribers

- There are around 230 million products and 64,000 sellers on Amazon.de

- 34 % of all product searches take place directly on Amazon

Amazon's success is based on three main pillars:

- Large selection

- Favorable price

- User experience/simple order processing

With its seemingly endless selection of products (230 million), Amazon manages to direct more users to its online store than any other online store. The low price and simple ordering process not only turn visitors into customers, but in many cases also into regular or Prime customers.

Amazon's A9 algorithm is a key success factor here. Amazon has been the most important product search engine in the western world for several years now. The A9 algorithm used is relatively easy to understand.

When a search query is triggered, the system first determines which products are relevant to the search query.

Whether a product matches the respective search query is determined by whether this search query is contained in the product listing (title, bullet points, keywords, product description).

If this is the case, the product is taken into account for the search query. However, this does not mean that the product will be displayed on the first search results page. Rather, the mention of the respective search query is the minimum requirement for the product to be included in the "shortlist".

Once this filter function has been applied, the filtered products are sorted according to performance factors (number of sales, conversion rate, click rates, etc.). As a result, products with the highest relevance and the best performance values are displayed in the top (organic) positions. This filter function ensures that, on average, the results displayed represent the products with the highest purchase probability.

The purchase probability is calculated in particular using historical values such as purchase frequency and the keyword-specific conversion rate.

Ultimately, this type of presentation means that already popular products receive an even greater share of impressions, clicks and purchases. This type of presentation is therefore both a strength and a weakness, because on average, customers are shown relevant products, but at the expense of individual and personalized product presentation.

Examples of a lack of product diversity and personalization

In the following, I will show you some examples to illustrate the lack of personalized or individualized presentation.

Search query: Sunglasses for men

Display of 16 organic product listings

All product listings displayed on the first search results page have a relatively low retail price (€8.99 to €25). Furthermore, no established sunglasses brands are displayed. Although Amazon has sufficient data from my sales history to indicate a clear brand preference in the higher price segment, only private label brands in the lower price segment are displayed.

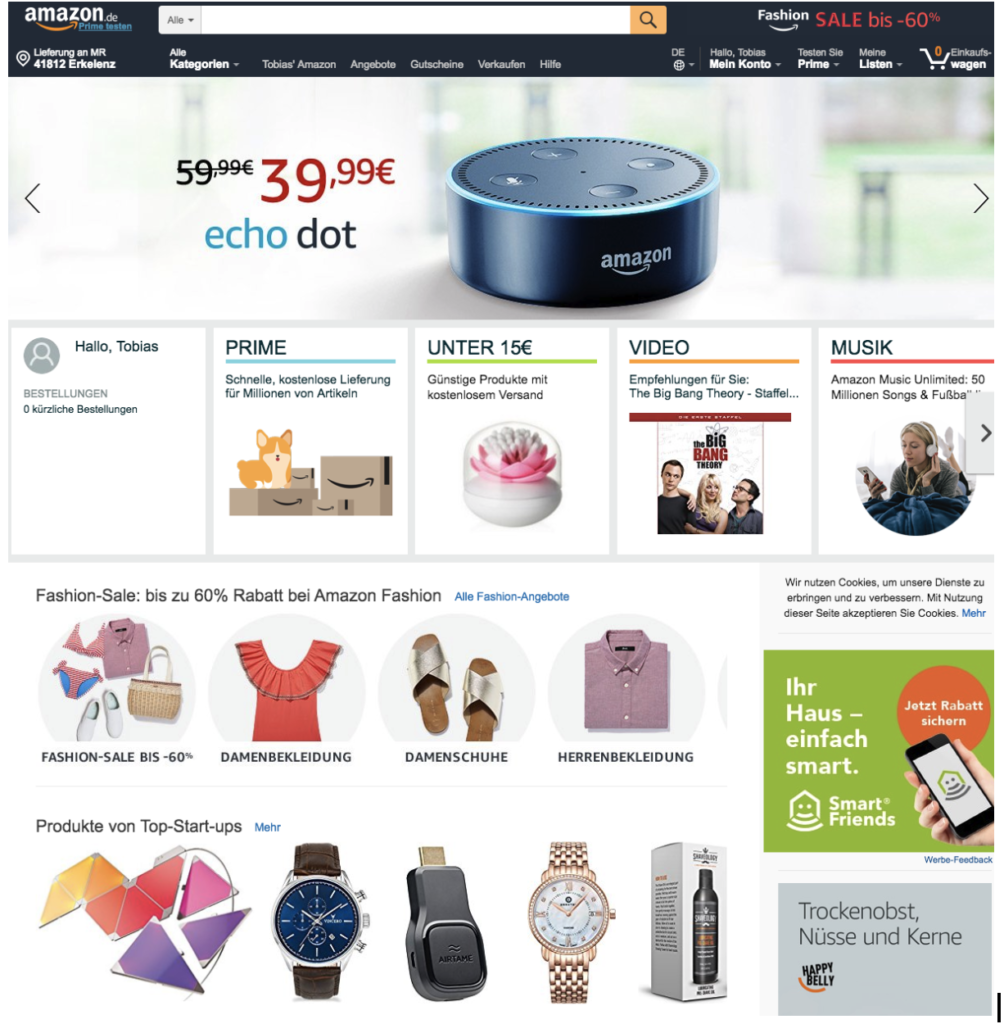

If you look at Amazon's homepage, you quickly realize that Amazon is not a source of inspiration for products. Amazon is currently geared towards meeting demand. So if you are clear about which product or which product categories you want to buy, Amazon is almost unbeatable thanks to its large selection, low prices and fast delivery.

However, with this strategy Amazon is neglecting impulse buyers, who do not buy products because they have a specific need, but because they want the product. In doing so Impulse purchases with 70 % make up the majority of retail sales. However, these impulse buyers are not picked up by Amazon's search function, as they do not have an acute need to purchase a product.

Impulse buyers can therefore only be won over by personalizing the shopping experience. Unfortunately, there is no provider in online retail that can serve as a benchmark for the personalization of the shopping experience. Even providers such as Wish, which advertise a personalized shopping experience, still have significant development potential in this respect.

YouTube is a platform that has done an exemplary job of personalizing the home screen in addition to answering search queries. Based on the number of search queries submitted daily, YouTube is even the second most popular search engine the world. However, YouTube not only answers search queries by playing suitable videos; no, it has also personalized the home screen in such a way that YouTube users often only land on the home page and click through the videos suggested for them.

As a result, users not only visit YouTube when they want a video to answer a specific search query, but also when they are looking for entertainment. YouTube is not only the second largest search engine in the world, but also the second largest social network after Facebook.

YouTube would undoubtedly not be so popular if it only answered search queries. The personalized start page is the main reasonwhy users open YouTube several times a day. A recent analysis shows that 70 % of time spent on YouTube is invested in automatic, personalized video suggestions.

Amazon customers currently use the Amazon website or app when they need to make a purchase. If Amazon succeeds in activating users more frequently by personalizing both the search results and the homepage or home screens, Amazon could move away from being a pure Demand cover become a source of inspiration. This would allow Amazon to focus more actively on impulse buyers. Only by focusing more strongly on impulse purchases can Amazon achieve its annual Growth figures of approx. 20 % in the future as well.

RemarkOf course, impulse purchases already take place on Amazon, but the current website and the app are hardly designed for this. In order for more impulse purchases to take place on Amazon, the home screen would have to follow a personalized feed logic, similar to what YouTube, Facebook etc. currently do.