"Jeff Bezos built Amazon with resources that would have been illegal 50 years ago," says Lina Khan, who worked on the June 15, 2021 as the new Chairwoman of the Federal Trade Commission (FTC).) was appointed. Lina Khan is known for the strong influence of the big tech companies such as Google, Facebook, Amazon and Apple, more than critically. It even postulates that Amazon is abusing the market.

With the appointment of the new FTC Chairman it can be assumed with certainty that the gait of the American competition authority against Big Tech and Amazon in particular will increase significantly in the near future.

Khan is a strong advocate for Antitrust proceedings against the big tech companies and is optimistic about a possible split-up.

In the following article, I mainly refer to Lina Khan's ideas and criticism of Amazon's behavior, which here can be read.

Amazon: Too big & too powerful?

Amazon has become an integral part of our lives. Since its foundation in 1994, Amazon has indeed become the "Everything Store" managed. Products without an Amazon listing are hardly noticed, especially by Prime shoppers. Less than 1% of Amazon Prime subscribers are willing to compare product availability and prices via other marketplaces & stores. 63% the prime user finalize your purchase decision within one session without looking left or right. (Study).

Amazon's share of the total E-commerce sales in the US will exceed 50% for the first time this year. In 2020 alone, online sales on Amazon increased by 44%.

However, Amazon is much more than just an online store. A large part of the new FTC chief's points of attack relate to not only on Amazon as Retailer & Marketplacebut above all to Amazon as a company as a whole.

Amazon has many different business units, which are organized in different Maturity stages and Profitability are located. Some of these business areas are established and highly profitableothers are new and are in the process of loss-making start-up phase.

Nowadays Amazon is not only a retailer & online marketplace, but also an advertising platform, a delivery and logistics network, a payment service, a credit lender, an auction house, a TV and film producer, a fashion designer, a hardware manufacturer and a leading provider of cloud services.

This is also shown by Amazon's latest quarterly figures. Direct online retail makes only still 50% of total turnover out. Another third comes from the provision of platforms (AWS and Amazon Marketplace) and "third-party services".

In 2021, approx. 1 million people in the USA for Amazon, i.e. about 1% of the American workforce. One in every hundred employees in the US works directly for the tech giant. These figures do not include indirect employees, such as external delivery services, salespeople, tool providers and agencies.

Why hasn't Amazon been monitored and controlled more closely so far?

To answer the question of why Amazon has had no problems with the FTC so far, we need to look at the current Orientation of the cartel investigators in the USA.

The Opponent of antitrust proceedings against Amazon always argue with the same logic. Their credo is that Amazon has used its dominant market position not used to higher prices to end consumers. The Opposite is the case, Amazon deliberately passes on its margin to end consumers with low prices.

The focus on End consumer prices or "customer welfare" can be explained by the changed orientation of the FTC in the 1970s and 1980s.

In the 1970s and 1980s, there was a change of direction in antitrust law.

Since then, the focus has been on the short-term interests the interests of consumers, instead of the interests of the Overall market (e.g. from producers) should be considered.

The Antitrust doctrine nowadays refers largely to low prices and Product availability for end consumers in order to assess the competitiveness of a market. If prices for end consumers are low and product availability is not deliberately restricted, this is already a sufficient sign of a competitive market. functioning market. At least that is the current opinion of antitrust lawyers. This view is based on the "Chicago School of Antitrust".

The rigid focus on the End consumer prices was not always the main argument for possible antitrust proceedings. Since the Sherman Antitrust Act in 1890 through to the reorientation of antitrust law in the 1970s and 1980s, there were further points of reference for identifying market abuse. Two of these points are particularly relevant when assessing Amazon:

- The application of predatory pricing

- Vertical integration of own business units

Lina Khan, head of the Federal Trade Commission, is of the opinion that the sole Focus on low prices and product availability not is sufficient to classify a company's market situation as highly competitive and non-monopolistic in the 21st century.

The dangers for a free market can therefore not only be determined by price and supply volume. New and in-depth analyses are needed to identify the structures and market mechanisms of online platforms such as Amazon, says Lina Khan.

Amazon's business strategy for market leadership

In the "Amazon Antitrust Paradox", Lina Khan breaks down Amazon's business strategy into two basic directions:

- Corporate profits are foregone in order to achieve market dominance

- Horizontal and vertical expansion of the business divisions

Amazon forgoes corporate profits to achieve market dominance

For the first 20 years after Amazon was founded, company losses rather than profits were the rule.

Since its foundation in 1994, Amazon's focus has been on always on a growth course and not on profitability. The technology company was only able to grow to the One-stop store on the Internet. There is nothing fundamentally wrong with that. We are familiar with this principle from the start-up world. There, losses are accumulated over a number of years in order to achieve a significant market position in the long term.

However, Amazon is accused of Predatory pricing or "Predatory Pricing" to have destroyed the competition in the eBooks and diapers category.

Amazon started selling eBooks with prices below of the purchase costs for the top sellers in the category. When the Kindle is launched in 2007, Amazon is also expected to sell the Kindle sold below production cost to have the best possible High penetration of the market. Ultimately with success, because in 2009 90% all eBooks sold via Amazon.

How Amazon brought Quidsi (including Dipers.com) to its knees with predatory pricing

Until 2009, diapers for Amazon were none product that deserved attention. However, Diapers.com emerged as a competitor that was able to sell diapers online with a new mail-order concept and caused a stir. In 2010, Diapers.com achieved sales of 300 million US dollars. In 2009, Amazon made an attempt to buy Quidsi (the company behind dipers.com). However, the takeover bid was rejected by the founders.

Shortly afterwards, Amazon decided to raise the price of diapers by to reduce up to 30%. The aggressive pricing and marketing strategy cost Amazon approx. $200 million in lossesbut eventually led to success. Quidsi's growth slowed down, and investors were not The founders no longer wanted to invest further venture capital in the company. In 2010, the Quids founders were left with only the Sale of the company to Amazon for $545 million.

Following the acquisition of Quidsi increased Amazon has lowered the sales prices for diapers on the own platform (to be read among others here). In March 2017, Amazon decided to sell Quidsi set and to drive sales exclusively via its own platform.

Just one month after the Quidsi takeover, the FTC possible market abuse by Amazon. However, the investigations were declared closed by the FTC after 4.5 months. The takeover had led to none monopoly, as there were other retailers with the same range of goods (Coctco & Target).

Horizontal and vertical expansion of the business divisions

Amazon is already long is no longer just a marketplace or retailer, but also offers shipping and storage services or advertising opportunities on its own platform.

The intertwined business areas mean that Amazon customers (sellers) are also direct competitors. Sellers on Amazon not only use the platform Amazon for salebut often also their Shipping logistics FBA or the in-house advertising opportunities. According to Khan, these entangled business areas lead to conflicts of interest that are aimed at favoring the company's own products over those of its competitors.

Remark: There is no evidence that Amazon prioritizes its own products over those of its competitors.

Increasing market dominance across various business areas

Amazon FBA is a classic example for how the company has managed to achieve the Verticalization of the business divisions to expand its dominance over dealers, while at the same time creating its own Logistics network build up. As the popularity of Amazon FBA increased, so did Amazon's negotiating power vis-à-vis others Logistics companyto obtain the desired price limits and services.

Thanks to the improved negotiating positions and lower shipping costs that are passed on to Amazon FBA retailers, the retailers' dependency also increases.

This clearly illustrates how Amazon has managed to dominant platform to vertically integrate further business areas.

One of Lina Khan's main points of criticism relates to the preferential treatment of products that are stored and shipped via Amazon FBA. Since products that are shipped via Amazon FBA receive preferential treatment in the Search results pages and also in the fight for the buy box, this leads, according to Lina Khna, to "anticompetitive challenges in the retail sector".

Current Antitrust investigation against Amazon - June 2021 (USA)

In mid-June 2021, Karl Racine, Attorney General for the District of Columbia, opened a lawsuit alleging that Amazon's own policies required sellers to force, on other e-commerce platforms artificially high prices to demand.

In one Price parity regulationwhich existed until 2019, Amazon had completely prohibited its sellers from offering lower prices outside of Amazon. As this most likely would have led to antitrust complaint proceedings, the regulation was subsequently amended.

Instead, Amazon introduced the so-called "Fair Pricing Policy" feature. This enables Amazon to demand price adjustments if the seller's prices are significantly higher than the last sales prices offered on or outside Amazon.

Here, however not the product or the seller is blocked, but it comes to the Loss of the buy box and therefore also the option of adding products directly to the shopping cart. This makes it more difficult to complete a purchase on Amazon.

Whether the current antitrust complaint will be successful or not, remains to wait and see. However, Amazon will be forced to provide answers and thus share insights into its business practices.

Current Antitrust investigation against Amazon - June 2021 (EU)

The EU Commission is currently examining two points that could result in a possible antitrust complaint against Amazon.

The first investigation concerns the systematic use of non-public business data of Marketplace sellers to promote their own retail business.

Margrethe Vestager, Vice-President responsible for competition policy, commented:

"We must ensure that dual role platforms with market power, such as Amazon, do not distort competition. Data on the activity of third party sellers should not be used to the benefit of Amazon when it acts as a competitor to these sellers. The conditions of competition on the Amazon platform must also be fair. Its rules should not artificially favor Amazon's own retail offers or advantage the offers of retailers using Amazon's logistics and delivery services. With e-commerce booming, and Amazon being the leading e-commerce platform, a fair and undistorted access to consumers online is important for all sellers."

In the second The antitrust investigation concerns the possible preferential treatment of product offerings that are offered via the company's own logistics and delivery services "FBA" are offered by Amazon.

The Commission wants to find out whether the criteria used by Amazon to select the Winner of the "Buy Box The definition of "Amazon's retail business" leads to preferential treatment of Amazon's retail business or sellers who use Amazon's logistics and delivery services.

Click here for the EU Commission's statement.

The challenge of antitrust authorities taking action against Amazon

1. assessment of the size and importance of Amazon

When people talk about Amazon's dominance, most of the discussions relate to Amazon's market share in online retailwhich, as mentioned at the beginning, was launched in the USA this year via 50% will amount to. Measuring Amazon's size solely on the basis of online sales is questionable, as the majority of consumer spending continues to be made in brick-and-mortar stores.

Amazon's share of the total retail sales in the USA is "only" 9.2%, whereas Walmart is still ahead of the technology company with 9.5%.

If Amazon already has a market-dominating position with a 9.2% share of retail sales in the US, why was Walmart has not yet been observed more closely?

Amazon has certainly grown much faster than Walmart, and it is only a matter of time before Amazon also Walmart based on total retail sales in the USA overtake becomes. The sole focus on the share of online sales is however too short.

Amazon private label brands: Is it really reprehensible to be a platform operator and product provider?

A frequent accusation is Amazon's behavior based on sales trends. These are used to own articles and thus outperform competitors on the marketplace. At the same time, Amazon is Marketplace provider and Competitors. What may sound unfair at first glance has been a reality for over 150 years of common practice in the retail trade.

New sales trends are regularly used there to Own brands and use them to take on the competition. Often the retailers or marketplaces offer similar products to the existing competitor, but at a reduced sales price. A Example for this is the private label "Good & Cheap" from Edeka.

Why is the topic of Own brands criticized, but not at other retailers such as Aldi, Lidl or Tesco?

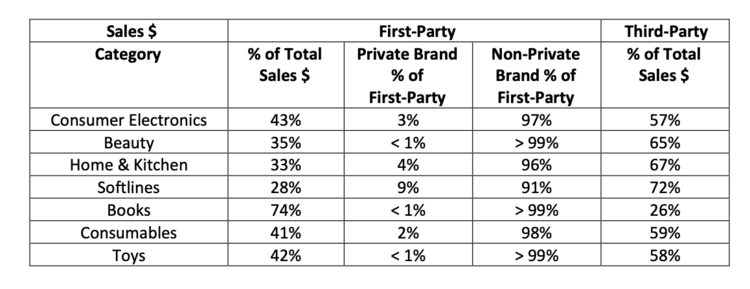

The sales volume of Amazon's private label brands across most categories is only 1-4% of category sales. The majority of sales are still generated by other third-party brands.

Amazon's own brands are anything but Category leader.

For most other retailers, private label products have a clear higher share of sales and turnover in the respective category. For example, private label products at Aldi a share of 70% from.

Source: https://www.congress.gov/event/116th-congress/house-event/110883

https://www.ben-evans.com/benedictevans/2021/3/28/amazon-private-label

Conclusion - Breaking up Amazon:

Is Amazon threatened with a split? This can only be guessed at the moment. However, the pressure on the technology company from antitrust authorities in the USA and the EU will increase dramatically. One of the most important tasks of the new Amazon CEOs Andy Jassy will be to appease the antitrust authorities.

The approach chosen to attack Amazon will also be interesting. There are certainly enough targets for the cartel watchdogs.