In today's article I present the 19 most common mistakes made by Amazon vendors, which I have noticed again and again in the last few months during my daily account support. By avoiding these mistakes, retailers should be able to optimize their sales and turnover figures. In the first points, I'm talking in particular about optimization potentials around the topics Amazon-SEO and Amazon advertising campaigns.

Other points I will mention in this article include mistakes in product presentation, product upload, buybox monitoring and sales via other channels and to other countries.

1. incorrect use of backend keywords

Every Amazon seller can (and should) use backend keywords for the products he offers on Amazon. In the vast majority of Amazon accounts that I optimize, I always see the same errors when using the backend keywords.

In total, keywords can be specified with a size of 249 bytes. However, I always see accounts that clearly exceed the keyword limit. However, if the limit of 249 bytes is exceeded, all entered keywords are ignored. Therefore, the first optimization measure to be taken is to make sure that the byte limit is not exceeded.

The following rules apply to byte allocation:

Letters (A-Z) and numbers from 0-9 correspond to one byte.

For umlauts (Ä, Ü, Ö) 2 bytes are counted.

Special characters, like the € sign, are counted as 3 bytes.

Another error, which I notice again and again during the revision of the backend keywords, is that already used keywords are also entered in the backend keywords. In principle, keywords that are already included in the listing do not have to be mentioned twice. The keyword frequency does not play a role in Amazon listing optimization and can therefore confidently be neglected. By removing the duplicate keywords, space is created for additional, unique keywords that increase the visibility of the products.

Further remarks regarding the use of backend keywords:

Keywords do not have to be named in the correct order to be considered. In this way, a specific term can be used in the product title that matches one of the backend search terms. If this combination of terms is searched for, the product will also be included in the index of the played products.

Upper and lower case letters are not taken into account.

Keywords with umlauts are also considered if the search queries do not contain the correct spelling (ä=ae, ö=oe, ü=ue).

2. no optimal campaign structure

Advertising campaigns are part of successful sales on Amazon. Be it sponsored products, headline search ads or display campaigns - without the active marketing of your own products via the paid advertising formats on the Amazon marketplace, it is impossible to sell successfully on Amazon. However, the creation of advertising campaigns is by no means enough, even if many manufacturers and retailers think so. In about 90 % of the accounts I optimize, I see a non-optimal campaign structure of the products. As a rule, campaigns should be structured according to products or brands.

This is what a non-optimal campaign structure looks like:

Campaign Brand X → Advertising group All products

Regardless of whether the campaign is automatic or manual, this campaign structure is not recommended. There are the following reasons for this:

All products in the ad group are now played out with possible keywords. Since these are usually different products (variants or completely different product categories), there is no clear product differentiation. Ads can now be played for search queries that do not match the respective search query at all (e.g. keyword "blue shirt", but ad "white shirt"). This ultimately leads to a lower click rate on the ads and thus to a lower quality factor. And when there are clicks on the ad, the conversion rate is usually unacceptable, causing unnecessary costs.

Another problem that arises with too large an ad group is the lack of clarity about which product was sold via which keyword playout. This problem cannot be solved completely, but smaller ad groups (< 5 products) can make more precise assumptions.

This procedure is also not optimal for the playout of automatic campaigns, since only one standard CPC can be determined at ad group level. In the case of a very heterogeneous product range with different sales, margins and conversion rates, a standard CPC is not the best solution. To avoid this problem, several ad groups with a few very homogeneous products are recommended. Only products that cover the same search terms should be sorted into an ad group. This applies in particular to the characteristics of the products such as size and price. Therefore I recommend the following campaign structure:

Campaign Brand X → Ad group blue + XL (Exact)

→ Display group red + L (Exact)

→ Display groups green + M (Broad)

etc.

3. insufficient time for campaign analysis

After the first advertising campaigns have been launched, "newcomers" in particular prefer to analyze and adapt their campaigns on a daily basis. However, this enthusiasm is counterproductive, as Amazon campaigns in particular need some time to generate enough figures as a basis for campaign optimization. Firstly, the "current" data in the campaign report are not up-to-date, but are often delayed by 24 hours. Another point to keep in mind is the attribution window for advertising campaigns on the Amazon marketplace, which is 14 days. This simply means the following:

If a potential customer clicks on your ad, but does not place an order immediately, but calls up the advertised product again within the next 14 days and then orders, this order is added to the campaign/ad with which the customer was in contact. This ultimately means that key figures such as turnover, orders and AcoS change subsequently. For this reason, I always advise you to place the analysis window of the campaigns at least 7 days before the analysis date, so that the true effects of the advertising campaigns can also be analyzed. (The 7-day rule has established itself with me, but of course it is also possible to analyze after 14 days).

Another reason why campaigns should not be "optimized" too hastily is the amount of data collected as a basis for decision-making. When optimizing advertising campaigns, I always decide on the basis of data such as clicks, CPC, AcoS, etc.. An essential part of the optimization is the removal of non-performing keywords or the reduction of the maximum CPC for certain keywords. However, the first question that arises here is when a keyword is not performing. Are there 10 clicks without buying? Or 25 clicks after all?

In this respect, I cannot name a general benchmark, since the conversion rates differ depending on the product category and price class. However, you should make sure that keywords are not voted out too hastily. As a benchmark, the product-related conversion rate can be calculated with a certain discount.

Example: Product A has a product:

Product A has a product-specific conversion rate of 5% - that is, a sale is generated after 20 visits/clicks.

As a rule, in order to identify non-performing keywords, I assign a discount of 25% to advertising campaigns.

As a result, if more than 25 visitors (conversion rate 4%) have been reached via a keyword and no purchase has yet been made, the keyword is deselected or its maximum CPC downgraded.

Such decisions can only be made if enough data is available!

4. exclusive campaign optimization based on AcoS evaluation

AcoS stands for "Advertising costs of Sale" and is one of the most important KPIs for advertising campaigns, as it relates the advertising costs to the advertising revenues.

Example: Our product costs 100 € and an average of 20 € is needed to market it through advertising campaigns - then the AcoS is 20 %.

The AcoS is a relatively easy to understand KPI and serves most sellers as an important factor. The goal of most sellers is to reduce the AcoS. However, retailers neglect key figures such as sales and turnover potential. If only a low AcoS serves as the target value and not the generated total sales and profit, then retailers leave a lot of sales potential unused.

To reduce the AcoS at campaign level, there are two possible measures for retailers. The first measure is the use of negative keywords to exclude non-performing keywords. Unfortunately, this leads to keywords being prematurely excluded without sufficient data being used for evaluation. This ultimately leads to a reduction in the number of advertised keywords and thus also in the number of impressions and conversions.

The second way Amazon merchants can reduce AcoS through campaign optimization is to reduce the maximum CPC of keywords. As a result, the costs per click are lower, but at the same time the number of possible clicks and thus the number of possible conversions is lower.

Instead of focusing exclusively on the AcoS, retailers should also consider the sales development and the total profit achieved. Particularly in highly competitive product categories, it can make strategic sense to accept an unprofitable AcoS in order to gain visibility in organic search results.

5. a limited daily budget and insufficient keyword bids for advertising campaigns

Another optimization point, which I regularly see in advertising campaigns on Amazon, is an insufficient daily budget, which is already exhausted in the course of the day. With a limited daily budget, merchants miss out on both impressions and sales. For this reason, the campaign manager should be checked regularly, as the message about a too small daily budget is played out there.

The problem with too low keyword bids is that the probability that the own advertisement is played out for the respective search term is very low. The keyword bids should be slightly higher, especially at the start, in order to be able to compensate for the missing quality factor with higher CPC.

Both points - a limited daily budget and too few keyword bids - lead to the fact that it is not possible to get the most out of Amazon campaigns.

6. use different keyword options at a single ad group level

Another error that I often see in account audits is the use of different keyword options in a single ad group. This error goes in the same direction as the errors discussed in point 2. For advertising campaigns on Amazon (sponsored products or headline search ads), there are three different keyword options that can be used to control ad playout: "Broad Match", "Phrase Match" and "Exact Match". To learn more about the different keyword types, you are welcome to read the article "Instructions for Sponsored Product Campaigns".

By using multiple keyword options in a single ad group, keyword overlaps can occur, making the ad suitable for a search term with multiple stored keywords. Ultimately, this makes campaign optimization more difficult, as search terms can now be played out across several keywords and these must be taken into account.

7. no use of negative keywords

When using negative keywords, Amazon merchants can better control the playout of advertising campaigns, as the use of negative keywords tells Amazon for which search terms the ad should not be playout. In particular, negative keywords should always be used for manual broad match campaigns and automatic campaigns, so that no unnecessary budget is spent on keywords that match the advertised product.

During the daily campaign optimization I notice again and again that campaigns are switched off prematurely if they do not reach the desired target values. A glance at the keyword report is often enough to see which keywords are responsible for sales and which are responsible for costs. As a rule, these are only a small number of search terms that are responsible for the fact that target values are not reached. These search terms should be determined and finally booked as "negative keywords".

8. placement of advertising campaigns on non-optimized product listings

In addition to optimizing advertising campaigns, the product listings on Amazon should also be created in such a way that there is a high probability of conversion. Again and again I observe the phenomenon that advertising campaigns do not deliver satisfactory results. In these cases, the campaign design is usually criticized prematurely without getting a more precise overview of the advertised products. An optimally created campaign is only half the battle, the other 50% is determined by the product listing. Without an optimized product listing, the target values of the advertising campaign will also be difficult to achieve. Product listings with only one product image, little description, poor shipping conditions and a sales price that is significantly higher than the competition have a significant impact on sales through advertising campaigns.

Therefore, advertising campaigns should not only focus on the campaign structure, keyword bids and keyword options, but of course also on a conversion-optimized product listing. By optimizing product listings, I was able to observe a reduction in AcoS of up to 50% in practice.

9. no campaign playout for products that are already displayed on the first search results page

Another mistake made by some merchants is the deactivation of advertising campaigns for products that appear as organic placement on the first search result page for the main keyword. The following argument is usually used here: Why should money be invested in an advertising campaign if you already have an organic placement on the first search result page? However, the fact that advertising campaigns can achieve a second presence on the first search result page and that by switching off advertising campaigns the placement on the first organic search result page can also be lost is usually not taken into account. Just because the respective product appears on the first page or even occupies the first organic placement does not mean that the maximum turnover has already been reached. Advertising campaigns should therefore be placed independently of the organic placement. With every additional sale of one's own product, it is also prevented that the customer acquires a competitor's product and can thus establish a customer relationship with the competitor.

Brief summary: The first nine points related to mistakes and misunderstandings in the placement of advertising campaigns on Amazon (sponsored products, headline search ads, etc.) and optimization for Amazon search (Amazon SEO). In the next step, I now present mistakes and misunderstandings in other areas when selling on Amazon.

10. exclusive focus on main keyword

It is relatively easy to find the main keywords for a product. For example, if customers want to buy a vitamin B product, they will search for "vitamin B". However, this is not true for all buyers! There are enough customers who have a different search behavior. So it can be a more specific search query, such as "vitamin b complex vegan". If now the different search inquiries are not considered, then the own product does not appear for these kinds of the search inquiries also. Therefore, you should not focus exclusively on the main keywords, which are usually very obvious. As a result, the competition for these main keywords is very high and it is therefore also very difficult to win relevant placements. Focusing on longtail keywords not only ensures that quick successes can be measured, but also leads to a higher conversion rate than generic main keywords.

An example:

What exactly does a customer look for when searching for "vitamin B"? It could be a "vitamin B complex" or also a "vitamin B12 preparation". Furthermore, it is not yet clear whether the customer is looking for tablets or a liquid vitamin B preparation. This very generic search query ultimately leads to a high search volume, but in comparison to specific search queries (longtail) to low conversion rates.

Due to the increased competitive pressure with generic search terms, the recommended CPC for advertising campaigns is usually also higher than for specific search queries, which leads to a lower efficiency of the advertising budget.

11. non-compliance with the Amazon style guides

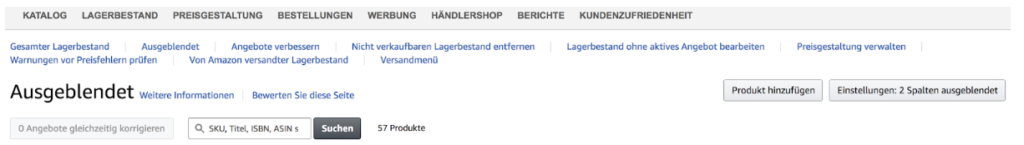

Amazon style guides are general requirements for product presentation on the marketplace. The style guides differ depending on the category, so that generally valid statements about when a product listing does not conform to the Amazon style guides can hardly be made. A representation of the different style guides can be found here. Failure to comply with the Amazon style guides can result in listing components such as the title or images not being played out as desired. In some categories Amazon has already implemented "filters" that categorically reject listing components that are not style guide compliant. Unfortunately, Amazon merchants are not informed about these measures. Furthermore, it regularly happens that products that do not correspond to the style guides are hidden and thus cannot be found and bought. The fading out of articles inevitably leads to sales declines and should therefore not be ignored.

In order to obtain a list of the hidden products, select the menu item "Hidden" in the inventory management, as can be seen below.

12. product variants not shown as variants

When selling on Amazon, the products offered can be offered either with or without a variant. Which variant relationships are possible is shown in the style guides of the respective category. Not creating product variants (e.g. T-shirts in different colors) is an error that is committed regularly. Causes can be ignorance or lack of time. However, product variants offer some advantages that can increase success on Amazon. The first advantage is that product reviews of the variants are added together (as of July 2018: there are currently some adjustments in the playout of reviews).

By merging the ratings, the number of ratings for each of the variants increases, which in the case of good ratings ensures that potential customers have a higher level of trust. The second often underestimated point is the increasing probability of upselling and cross-selling, as the product variants are immediately displayed on the product detail page. Especially when merchants work with promotions such as 10% discount on the purchase of 2 products, product variants are an excellent way to draw attention to other products.

13. wrong category selection during product upload

An essential product feature that should not be missing from the product presentation on Amazon is the associated product category. When selecting the appropriate product category, Amazon retailers should analyze the different classifications in detail in advance, as it can happen that there are several suitable product categories for the respective product.

So a shoulder bag can be used both in

Shoes & Handbags > Handbags & Shoulderbags > Men's bags > Handbags

as well as

Suitcases, Backpacks & Bags > Handbags & Shoulder Bags > Men's Handbags > Shoulder Bags

can be classified. At first glance, there is no difference between the two classifications. However, there are different style guides for both categories, so that the presentation of the product listings and ultimately also the sales performance can differ significantly.

Without a thorough preliminary analysis, even the wrong product categorization can lead to a clear competitive disadvantage. 14.

14. no consideration of Amazon notifications (payment account verification, quality warnings etc.)

In addition to product presentation, the optimization of product listings and the placement of advertising campaigns, there are numerous other tasks associated with selling on Amazon. Account management also includes responding promptly to Amazon notifications. As a result, Amazon products are regularly made inactive because quality warnings such as missing attributes or brand names are ignored. For this reason, the entire stock should be checked regularly so that quality warnings are processed before the product is set to inactive.

In addition to quality alerts, there are a number of other alerts that occur regularly. If Amazon notifications are not taken into account, they can even lead to a deactivation of the entire stock in the short term if measures are not taken in time.

![]()

15. no monitoring of buy-box ownership

The buy box or shopping cart field is used to add products to the shopping cart. What is taken for granted in most online stores is not the case with Amazon, because every Amazon retailer has to earn the shopping cart field first. You can find out which criteria are taken into account in my blog post "Amazon Buy Box Criteria 2018". You have to know that not every retailer has the buy box for a product and that retailer can get the buy box and lose it again. If a product only has a small percentage share of the buy box, this naturally has dramatic effects on sales and turnover figures. Without a buy-box, the conversion rate decreases and advertising campaigns cannot be played out. This leads to lower organic visibility, which in turn means lower sales.

Many Amazon retailers take the buy box for granted and then wonder if their own products do not have the buy box. However, in order to sell successfully on Amazon in the long term, the analysis of the percentage buy box ownership is unavoidable, so that measures can be developed to increase the percentage ownership. In order to be able to evaluate the percentage of buy-box ownership per product, statistics & reports are selected in Seller-Central under Reports → . Then we select in the left sidebar the menu item "Detail page sales and traffic by superior product". Now we receive an evaluation per parent product with KPIs such as order total or ordered units, but also a view that reads as follows: "Shopping cart field percentage". Here we can see how often the products have the buy box.

In my opinion, this analysis is carried out far too rarely and should be regularly compared with previous periods so that action can be taken to increase the percentage of the shopping cart field.

16. out-of-stock problem

Inadequate inventory when selling on Amazon can lead to long-term disadvantages in sales performance. This not only affects missed sales while the products are not in stock, but also the risk of ranking losses. The problem can be counteracted relatively easily, because in Amazon-Seller-Central retailers find the Amazon sales coach, who draws attention to a low stock level and even calculates how long the current stock will last in days (based on sales data of the last 30 days).

17. missing product differentiation / missing USP

In the 16 previous points, I haven't even mentioned the product to be sold. However, this has the greatest influence on success or failure when selling on Amazon. The majority of Amazon retailers sell products that do not have a clear differentiation and no clear advantage over competing products. As a rule, these are me-too products that only differ in terms of a different brand name and packaging, but nothing more. However, an undifferentiated product in a very competitive product category (just take a look at the categories of various dietary supplements) can sooner or later not only be successful through Amazon-SEO and Amazon campaigns.

For this reason, product research with competitive analysis (incl. SWOT) is inevitable if long-term success is the goal.

18. no internationalization on the European marketplaces

A huge advantage of selling on Amazon is its relatively simple internationalization. With just a few clicks, revised product listings and campaigns that are geared to the respective target country, Amazon dealers can easily reach customers in France, Spain, Italy and the United Kingdom. Through internationalization, retailers not only open up new sales markets, but can also successfully occupy the sales markets in France, Italy and Spain, which are characterized by low competition, in the long term (keyword: First-Mover-Advantage). Unfortunately, I hardly see any Amazon account as a well thought-out international strategy for being successful in all markets.

19. exclusive focus on the Amazon marketplace

Amazon is undoubtedly the most important online marketplace for selling products. However, I consider the exclusive distribution via Amazon to be grossly negligent, because there are enough people who move on platforms like Google, Facebook, Instagram or Pinterest and can already be picked up there by the retailer. As a rule, these are people who do not yet have an active buying interest.

But this is also the reason why these platforms are so attractive, because through a first brand contact outside of Amazon, merchants can build a customer relationship that Amazon will never make possible. An emotionally charged brand that is built up via social media can not only enjoy a loyal customer base, but can also assert a higher price level than an Amazon dealer who sells his products exclusively via the Amazon marketplace.

A successful brand development, which nowadays is largely achieved via social media, also leads to people actively searching for the brand in the long run and not for synonyms. This is reflected in the advertising costs at the latest.

Conclusion:

With this article I have presented the most frequent mistakes and misunderstandings in connection with the sale on Amazon, which I notice in my daily work. The 19 points mentioned prevent retailers from exploiting the full potential of selling on Amazon. Very probably there are numerous other points that I could not describe in this article. I will, of course, adapt and expand the article over time. I hope that I was able to give you some tips and food for thought, and wish you every success in selling on Amazon.